What is Interchange?

Visa, Mastercard and other card brands use Interchange Fees as transfer fees between banks and providers. Interchange fees are dependent on how you, the business, take your payments (is the card at the machine?) and the type of card (does the card have rewards?)

Transaction Type

You can take payments by card in multiple ways, whether on your machine, through a keyed transaction on a virtual terminal, or on your website through an e-commerce gateway.

Whether your transaction takes place with the Card Present or the Card Not Present affects Interchange Rates.

Card Type

Credit cards come in all shapes and sizes – when it comes to rewards and cashback options. When a credit card is associated with rewards, loyalty, or points programs, its Interchange rate will change.

It also matters where the card was issued. If the card was issued outside of Canada, there are unique fees from the card brands.

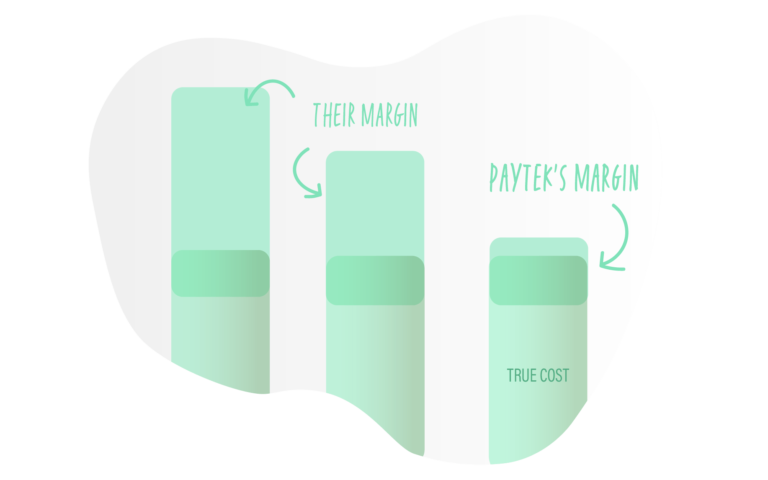

Interchange fees are charged to the merchant service provider, like Paytek. It’s up to the provider how they pass these fees on to you. Most of the big providers out there will cover the cost (and make a profit) with a bunch of fees on each transaction.

With Paytek, pay the exact cost from the card brands – everytime. No hidden fees, no hassle.

What are Assessment Fees?

As a part of the fees paid to the card brands like Visa and Mastercard, merchants are responsible for Assessment Fees – these fees are dedicated to the card brand’s operational expenses. Just like Interchange, Assessment Fees are the same for any provider, and depend on whether the card was issued inside of Canada or not.

Some processors will mark up Assessment Fees and call them “Card Brand Fees” on their statements. At Paytek, we believe pricing should be fair and transparent – we’ll never adjust the fees from the card brands.

See the current Interchange Rates below

Card Present Interchange Rates

| Card Type | Canada Visa Interchange Rates | Canada Mastercard interchange rates |

|---|---|---|

| Swipe/Chip Consumer | 1.250 % | 0.920% |

| Swipe/Chip Infinite/High-Spend | 1.570 % | 1.220 % |

| Swipe/Chip Corporate | 1.900 % | 2.000 % |

| Swipe/Chip Infinite Privilege/Premium | 2.080 % | 1.560 % |

Keyed or Card Not Present Interchange Rates

| Card Type | Canada Visa Interchange Rates | Canada Mastercard interchange rates |

|---|---|---|

| Keyed Consumer | 1.450 % | 2.060 % |

| Keyed Infinite/Premium | 1.700 % | 2.300 % |

| Keyed Corporate | 2.000 % | 2.000 % |

| Keyed Infinite Privilege/Premium | 2.450 % | 2.540 % |

Recurring Payments Interchange Rates

| Card Type | Canada Visa Interchange Rates | Canada Mastercard interchange rates |

|---|---|---|

| Recurring Consumer | 1.250 % | 1.760 % |

| Recurring Infinite/Premium | 1.530 % | 2.000 % |

| Recurring Corporate | 1.850 % | 2.000 % |

| Recurring Infinite Privilege/High-Spend | 1.950 % | 2.240 % |

Charities and Non-Profits Interchange Rates

| Card Type | Canada Visa Interchange Rates | Canada Mastercard interchange rates |

|---|---|---|

| Swipe/Chip/Keyed Consumer | 0.980 % | 1.000 % |

| Swipe/Chip/Keyed Infinite/High-Spend | 1.170 % | 1.250 % |

| Swipe/Chip/Keyed Corporate | 1.800 % | 2.000 % |

| Swipe/Chip/Keyed Infinite Privilege | 1.950 % | 2.000 % |